Golf trading strategy

Trading golf is a great way to counteract the unpredictability of the sport and take advantage of the substantial odds on offer. Learn how to trade golf to lock in a profit, or reduce your risk with this golf trading strategy.

Why golf is perfect for trading

All sporting outcomes are at the mercy of luck. In golf, perhaps more than other sports, luck can play a significant part in determining the result because of the number of variables which can impact the final leaderboard. To improve your golf betting strategy you should consider the following factors:

- The weather

- Four-day time frame (72 holes, with 18 holes played each day)

- No consistent tee times means not all players play in the same conditions

- Golf courses vary in distance, surface type and layout

- Pin positions change each round

- Large field - most tournaments consist of more than a 100 players

- Scoring format means a player can be leading and blow it on one hole

While these variables make predicting a winner so difficult, they create plenty of trading opportunities for savvy golf bettors looking for value.

The back-to-lay golf trading strategy

Instead of having to pick a winner, trading golf on a betting exchange allows you to hedge your backed bets, by laying - learn how to lay a bet here - a bet on the same outcome, allowing you to:

- Guarantee profit whatever the outcome of an event

- Reduce your risk and potential losses

The back-to-lay golf trading strategy is based on you backing players before the tournament starts and then laying them if their odds move in your favour during the tournament to guarantee a profit.

Timing your trade is vital to maximising profit as the odds will fluctuate once the round is underway; understanding factors accurately such as a player’s composure under pressure, the holes they still have to play or the changing weather will help you.

How to identify golf players to trade

Trading golf markets relies on your ability to identify players who are undervalued in the market and suited to the specific conditions of the tournament.

Before the start of each event you need to identify players you believe offer value compared to their market price, and that their odds will shorten over the course of the four days. There are a number of variables you need to consider before picking players to trade.

Current form

Firstly you should consider a player's form. It’s vital when looking for less popular players and can help you spot up and coming talent, which can offer you value before others in the market recognise it.

Study recent finishes - top 25 - leading up to the event, and be wary of players who haven’t come close to competing in any of their last five outings.

The table below shows if the winner of a tournament had recorded a Top 25 or Top 10 finish in the five events leading up to their win. Data from (23 October 2016- 11 June 2017).

|

Tour |

Winners |

T10 |

T10 % |

T25 |

T25 % |

|

PGA Tour |

30 |

23 |

76.60% |

27 |

90% |

|

European Tour |

24 |

15 |

62.50% |

19 |

79.20% |

This highlights that recent form is a great place to start and is consistent across both the PGA and European Tour.

The course

Understanding the characteristics of the golf course and how previous tournaments have played out are also key. Some courses favour long hitters, while others are designed for accuracy, and some put a premium on putting.

Analyse previous statistics at the course, If the top-ten is packed with players that were long off the tee, but didn’t score that well with driving accuracy, then the course is likely to have wide fairways and little rough to negotiate. Ultimately you are trying to gauge an understanding of the test required and match this with player stats.

Player stats vs. the course

Form and course knowledge is vital, but to find real value, you must study a player's statistics both recently and throughout the season. The next step is to pinpoint the players that excel in the most relevant course stats - basically analysing player strengths and weaknesses and match them up with the course characteristics - both the PGA and European Tour websites offer a multitude of statistics on both players and courses.

As mentioned above some golf courses have individual characteristics. If a course requires a player to drive long, analysing recent driving distance and accuracy is vital. If the course is tight - such as Wentworth - and set up for players to miss the green and fairways, look at green in regulation (GIR) stats and the sand save % compared to the brutality of the bunkers.

It’s not hard to look at how players have performed at a course previously, but recognising which player’s game the course suits - even if they have struggled in the past - will help you identify value in the market.

Historical performance

Most courses on both the PGA and European Tour are used year-after-year, meaning you can quickly identify if a player favours or dislikes a certain course.

Recognising which players have performed well at a course in the past is a good indicator, especially if their stats favour the course characteristics and they enter the event in good form.

Likewise, if a player is in good form, but their stats don’t match up with the course, and they have struggled in the past, they would not be suitable.

Weather

Weather conditions are extremely important but obviously difficult to predict far in advance. Certain courses are positioned such that they are prone to specific conditions.

Links courses, usually located on the coast, suit a specific type of player and can have their very own micro climates. Identifying the type of player who excels well here may go beyond their form and stats, and into their heritage - players that have grown up learning how to play In local conditions.

How to trade golf markets

Now you have identified which player or players you believe will improve in price from what is currently available on the Smarkets exchange you should place your bets.

Then you find the optimum point during the tournament where the player or players odds have decreased so you can make a lay bet and guarantee a profit irrespective of the result.

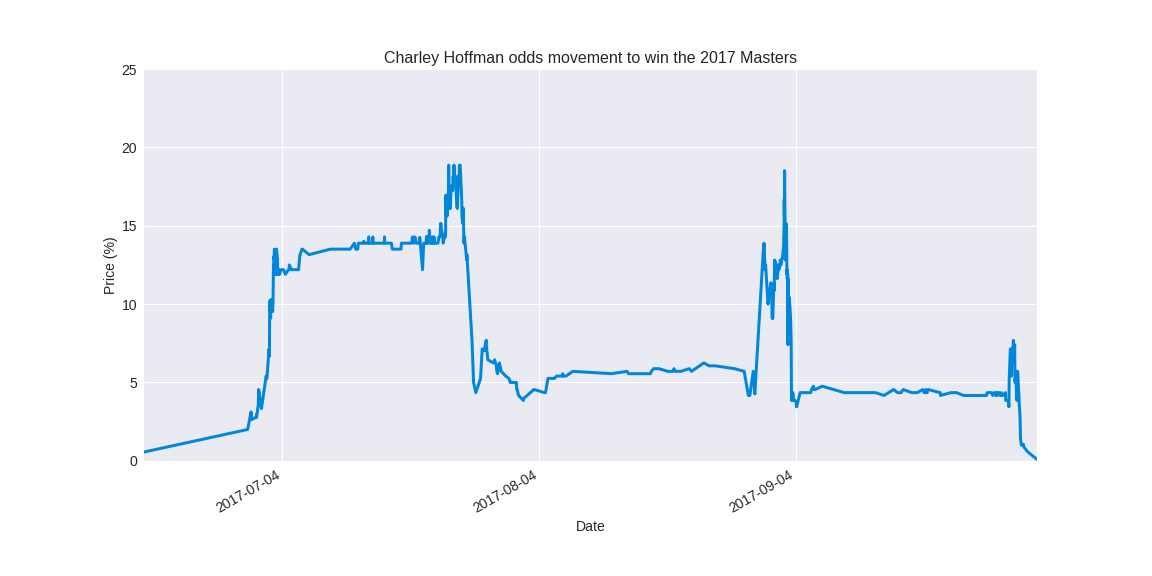

Let’s use an example at the 2017 Masters to explain how to trade golf markets. You have identified Charley Hoffman as potentially undervalued by the market.

Hoffman went into the Masters on the back of two Top-10 finishes - second at the Arnold Palmer Invitational and fourth at the Genesis Open - so we know his game is in good shape.

His stats show he is amongst the leaders in distance off the tee, strokes gained off the tee and in eagle percentage - all three are important on the long course of Augusta. Finally in his previous three outings at The Masters he finished inside the top 30 - his best T9 in 2015.

We’ve backed him for £30 at odds of 170, if he wins we would return £5,100 and a £5,070 profit.

The tournament began with strong winds and the much-fancied players struggled. Hoffman however, produced an unbelievable round of 65 - making nine birdies - and leaving him four clear of the nearest competitor.

The market has reacted and his odds are now available at 5.30 - an implied probability of 18.87%. You can now either let the trade ride and see if he continues his good form and the odds fall further, or if you believe Hoffman will not handle the pressure of leading the Masters, and ultimately fall out of contention, you can trade out.

To trade out you can use the Smarkets Trade out feature, or manually calculate with the equation below.

Initial back trade out calculation = (Back price * back stake) / current lay odds

So if you lay Hoffman now for £962.26, you will guarantee a return of £962.26 including stake, regardless of the outcome. Once you have deducted the industry-low 2% Smarkets commission for your winning bet, your overall profit would be £913.61.

But was that a good trade with Hoffman leading by four after day 1, when your profit if he won originally was £5,070?

The graph above shows the implied probability from the start of the tournament to its closure. After Day 2 Hoffman carded a round of 75 and his lead had been cut for a tied share of 4 under par.

Day 3 and after fighting back to lead the tournament by one - you can see his odds shoot up close to the 5.30 we traded out on - Hoffman found the water on the par-3 16th. Despite finishing with a level-par round he was now two shots behind the leaders, and the odds reflected his reduced chance of winning. The final day proved to be one to forget as he shot a 78 and finished in a tie for 22nd place.

In this example, it would have been a good idea to lay early, given the odds moved so quickly and there was still three days to go. Alternatively, if your selections don’t perform as well as you had hoped, you can use the lay strategy to minimise losses.

Trade with the best golf betting odds

To maximise your profit when golf betting, you should always look for the best golf odds.

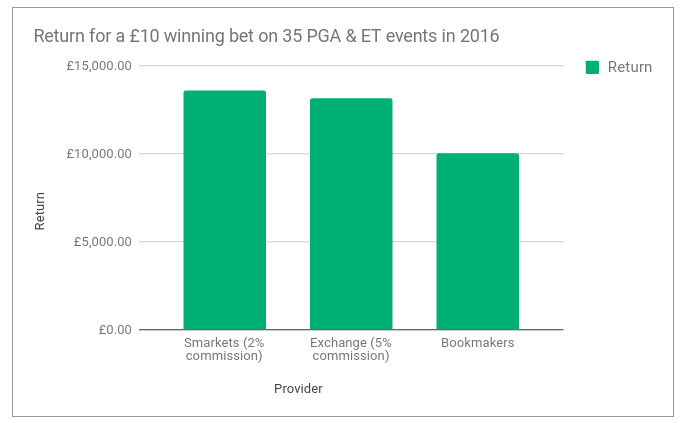

The graph below shows your return with Smarkets compared to an exchange who charge 5% commission and bookmakers from a winning £10 bet on 35 PGA and European Tour events in 2016.

You would have made a return of 3.16% more with Smarkets compared to an exchange charging 5% and 35.44% more than bookmakers.

This clearly highlights the importance of trading golf with the best odds - and that’s what you get with Smarkets industry-low 2% commission.

Apply this to golf betting

Now you understand how to trade golf betting markets, it can bring a new dimension to your betting, and when used intelligently can optimise your profit and minimise your risk.

Remember, always analyse the data for both players and the course to help you identify which players offer value. And then bet with the best golf odds.