How to trade football outright betting markets

Long-term outright football betting markets provide enough volatility for bettors to find a number of profitable trading strategies throughout the season. Learn how to trade football outright markets and what factors to consider before betting.

Why football outright markets are perfect for trading

Luck plays a part in all sporting outcomes, especially over 90 minutes of football. However, long-term football outright markets such as the league winner, who will be relegated or top goalscorer allow users to trade their position to counteract this variance over a season. When trading football outright markets you should consider a number of key factors, including:

- Transfer activity

- Squad depth

- Fixtures

- Wage bill

- Domestic/European competition commitments

- Streaks

- Injuries

While predicting most of these factors is near-on impossible, they do create plenty of trading opportunities for savvy football bettors looking for value. The reason? Bettors tend to discount new information too soon, despite there being plenty of factors with the ability to influence the course of history.

The football outright trading strategy

Instead of a hopeful pre-season bet on the Premier League winner, trading these markets on a betting exchange allows you to either hedge your backed bets, by laying - learn how to lay a bet here - a bet on the same outcome, or vice versa, by laying and then backing a selection. Both strategies allow you to:

- Guarantee profit whatever the outcome of an event

- Reduce your risk and potential losses

For a back-to-lay strategy you want to identify an outcome that is undervalued by the market. You then back at high odds and lay if the odds move in your favour throughout the season.

A lay-to-back strategy focuses on identifying outcomes which are overvalued by the market. You lay at low odds, and back the same outcome when the odds drift enough to give you a profit.

Essentially, when trading football outright markets you want to back at high prices and lay at low odds.

Factors to consider when trading football outright markets

There are a number of factors to consider when trading football outright markets. We have discussed some of them in detail below.

Relative wage bill

The correlation between wages and final league position is a good indication of how well a team should perform over a season.

Kuper and Szymanski (2009) found that it impacted the final league table so much that 92% of differences can be explained by a club’s relative wage bill. This doesn’t mean the team with the highest wage bill will always win the league, and the lowest will be relegated, but over time, the correlation is near perfect.

It’s no longer enough to spend money, teams have to spend at a faster rate when compared to their rivals. If teams don’t continue to spend, they will decline and drop down the table.

Obviously, there will be outliers like Leicester City in 2015/16 when they won the Premier League with the 15th-highest wages in the division. However, the general rule is the biggest relative spenders will be in with a chance to win the league, while the lowest are in trouble of relegation.

The betting advantage of understanding a team's relative wage spend is you can forecast longer term success or failure. It will also help you trade the season as you will know if a team is over or underperforming their expectations relative to wages - knowing this will allow you to find value on the basis you expect teams to recover or drop points once the variance or luck regresses to the norm.

Before the season starts aim to identify teams who are struggling financially, haven't spent much or sold key players as more likely to struggle, while teams who spend lots of money will see their prospects increase over time.

This information allows you take advantage of interim success or failure by backing or laying a team and trading out when they return to their expected place in the league. Alternatively, you can take a longer approach, and benefit from the volatility as the season progresses.

Transfer activity

Transfer activity on both players and managers can have a big impact on how the outright football markets react.

In the 2016/17 season, Manchester City hired one of the most successful managers in recent history in Pep Guardiola and spent £153m on transfers. This, according to the press, would likely lead to a lot of success.

City opened the 2016/17 Premier League outright market as favourites with odds of 3.55 - giving them an implied probability of 28.17% - this offered value as their odds dropped to a low of 1.69 (implied probability of 59.17%) about a month into the season on September 21. However, their odds quickly rose after a number of poor results and they eventually finished third and 15 points adrift of winners Chelsea.

Understanding the hype surrounding transfers and manager movement and how the market reacts presents a number of trading opportunities on the outright markets; lay an overreaction, and back undervalued news.

At the other end of the table look for teams who are selling their best assets without reinvesting into the team. So far during this pre-season Stoke have sold Jon Walters to a rival team, star player Marko Arnautovic, regular Glenn Whelan, while Wilfried Bony isn't returning on loan.

Signings have so far been limited to Kurt Zouma and Josh Hyman despite efforts from manager Mark Hughes. Added to this, their home advantage is eroding, despite consecutive finishes of ninth between 2014 and 2016, Stoke dropped to 13th in 2016/17. Is this regression and exit of high-profile players a turning point for The Potters? The question as a trader you have to ask is, do Stoke offer value in the relegation market?

Streaks

Recognising when short and long-term streaks will continue or end is key when trading outright football markets.

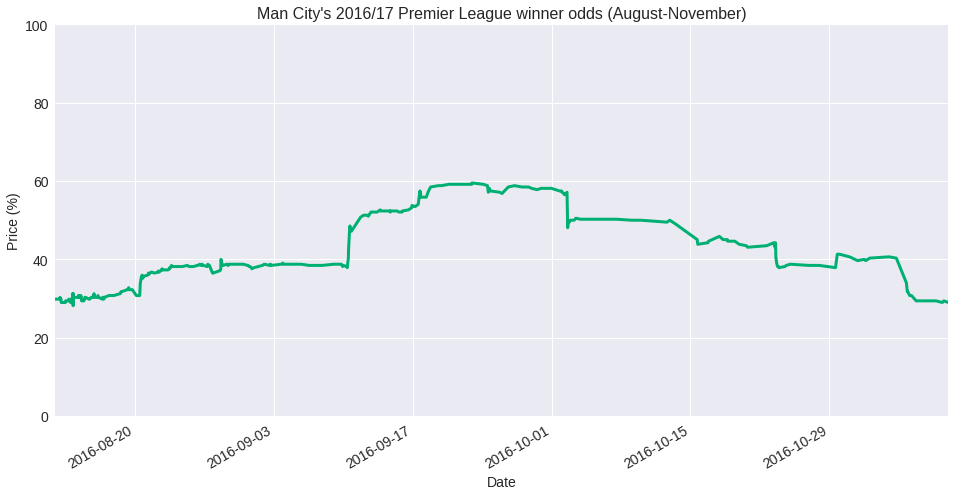

Let’s use Man City again as an example of how you can trade on winning streaks. The graph below highlights City’s odds from the start of last season until November 5.

You can see they started the season at odds of 3.55, after their first win at home to Sunderland they shortened to 3.40.

Three games later they had beaten Manchester United convincingly at Old Trafford and bettors backed them to win the league with their odds in at 2.079 (implied probability of 48.08%). Two more wins followed against Bournemouth and Swansea meaning they had won their opening six games, and the odds now had them at 1.69 - a 59.17% implied chance of winning the title.

As the graph shows, their odds subsequently dropped to 2.03 after suffering a 2-0 defeat against Tottenham. The next four games saw them win one and draw three, resulting in their implied chances of winning the title drop to 28.9% (3.45). This shift from a high of winning six consecutive games, to then winning one of their next five in the Premier League resulted in a drop in price of 51%.

Looking at the odds retrospectively, the market overreacted to City’s six-game unbeaten run - especially when the average finishing position at the end of the season for these teams was 12.6, compared to the next five games average of 9.2.

The hype of Guardiola’s arrival, new signings and the defeat of rival manager Jose Mourinho and United perhaps caused the market to react too quickly. Knowledgeable traders, however, would have realised there were 32 games still left to play, and therefore would have been presented with numerous trading opportunities to lock in a profit.

At the other end of the table, a bad run can send an average team towards the bottom of the league and threatened with relegation.

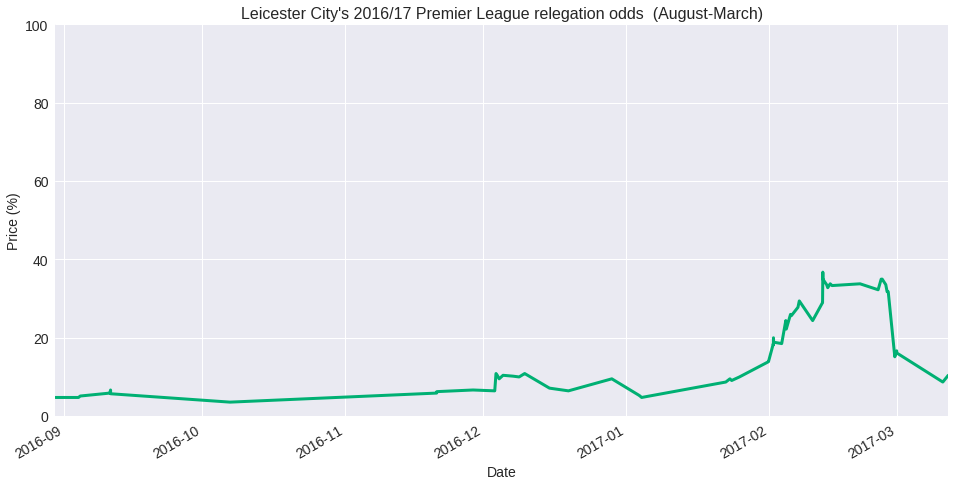

Let’s look at 2015/16 surprise winners Leicester. After an unbelievable season the previous year, breaking the monopoly of the bigger clubs, Leicester - who the season before just avoided relegation were priced at 16.50 to be relegated - a 6.06% chance.

Leicester's odds dropped giving them a 3.57% chance of being relegated on October 6 despite only having eight points from their opening seven games and being four points above the relegation zone.

Despite defeat to fellow struggler Sunderland on December 3, with three wins in 14 matches and just four points from the bottom of the league, Leicester’s odds were still only 9.59 to be relegated irrespective of their extended poor run of form - giving them a 10% chance of going down.

Defeats to Burnley and Swansea meant by February 12 they had lost five in a row and were now just two points above bottom-placed Sunderland with their odds shortening to give a 24.39 chance of relegation.

With talks of a rift between manager and players, Claudio Ranieri was sacked just nine months after winning the title. The market reacted again with their odds dropping to 2.86, giving them a 34.95% chance of being relegated.

What happened next in the market was remarkable; in their first game without Ranieri they beat Liverpool 3-1 and resembled the team that had shocked the world just a few months earlier. Their odds for relegation rose dramatically to 6.60 - a drop of 15.15% chance of them being relegated.

This highlights the volatility of the markets, and how markets can ignore new data leaving plenty of opportunities to lock in a profit. No, Leicester were not relegated, but the odds on offer didn’t appear to represent the probability of them being relegated.

Bettors were clearly overvaluing Leicester's ability based on previous heroics and didn’t take the new information into consideration. Some traders would have recognised they were clearly a team on the plunge and backed them with a view of greening up when that price went significantly lower.

Mid-season managerial sackings

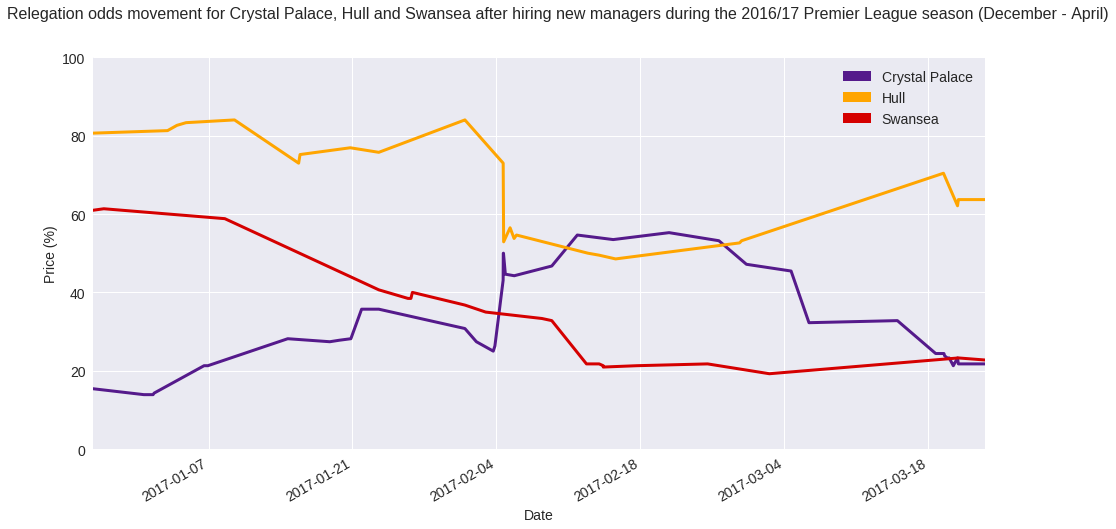

Managerial sackings around Christmas is part and parcel of the modern Premier League. In the 2016/17 season, three teams switched their manager over this period - Swansea, Crystal Palace and Hull.

The graph below compares the relegation price (in %) movement for the three teams mentioned from December 22, 2016 when the first of the three managers were appointed.

The relegation markets can be aware that a team's performance improves when the old manager is sacked and a new man is brought in. The price actually drifted when Crystal Palace and Swansea announced their new managers Sam Allardyce and Paul Clement respectively.

Allardyce, a renowned specialist in keeping teams in the top flight, signed on December 22 - just before the odds for Palace to be relegated were 5.29, and moved on news of his arrival to 7.14 - that’s a drift of 34%. The news of Clement’s arrival was not so optimistic despite Swansea drifting from 1.63 to 1.7 - a change of 4.2%.

Interestingly, when Hull replaced Mike Phelan with Marco Silva the odds shortened from 1.23 to 1.19 for them to be relegated. So why was this?

Despite having a good managerial record in Europe, the British public and mainstream media alike hadn’t heard of him. This, coupled with ill-informed views from pundits and a lack of English football experience, counted against him and the market undervalued his arrival. Even though he couldn’t save them from relegation, Silva did transform Hull as he won 1.17 points per game compared to 0.65 with Phelan - an increase of 79.9%.

Don’t underestimate the effect a new manager can have on a team. Given that all three teams’ odds drifted on them being relegated compared to the day they were hired, laying a team once a relegation threatened team have hired a new manager would have been a viable strategy.

Other factors to consider

Fixture schedule

Understanding the fixture schedules of each team is a good way of finding value trades in the outright markets. Look for the following runs of fixtures:

- Dense fixture period where teams will have to rest players and squad depth will be tested

- Easy or hard runs of fixtures

- End-of-season runs for teams who may be close to relegation

- Which teams are and are not in domestic and European cup competitions

Injuries

Injuries to key players will also impact the outright football betting markets. In the 2016/17 season, Tottenham were second, 10 points adrift of leaders Chelsea in early March and given a 5% chance of winning the title. A win against Everton, however, saw their chances of winning, according to the odds, (30.30) drop to 3.3%. Why?

It all relates to star striker Harry Kane hobbling off towards the end of the game. News soon surfaced that he faced a spell on the sidelines at a time when Spurs were gathering pace for a title challenge. Their odds rose further and then dropped to 6.90 five games later when Kane scored on his return and Chelsea lost to Manchester United.

This highlights that recognising the potential impact injuries will have on a team's chances of success accurately and reacting quickly will present opportunities for you to trade.

Apply this to betting

Now you understand how to trade football outright betting markets, it can bring a new dimension to your betting, and when used intelligently can result in a number of profitable trading opportunities.

Remember, always bet with the best football odds, which is what Smarkets offers with our industry-low 2% commission.